This post is also available in: Spanish

Key takeaways

- China’s official August retail sales and industrial production figures beat consensus expectations—a potential indicator of improved consumer willingness to spend.

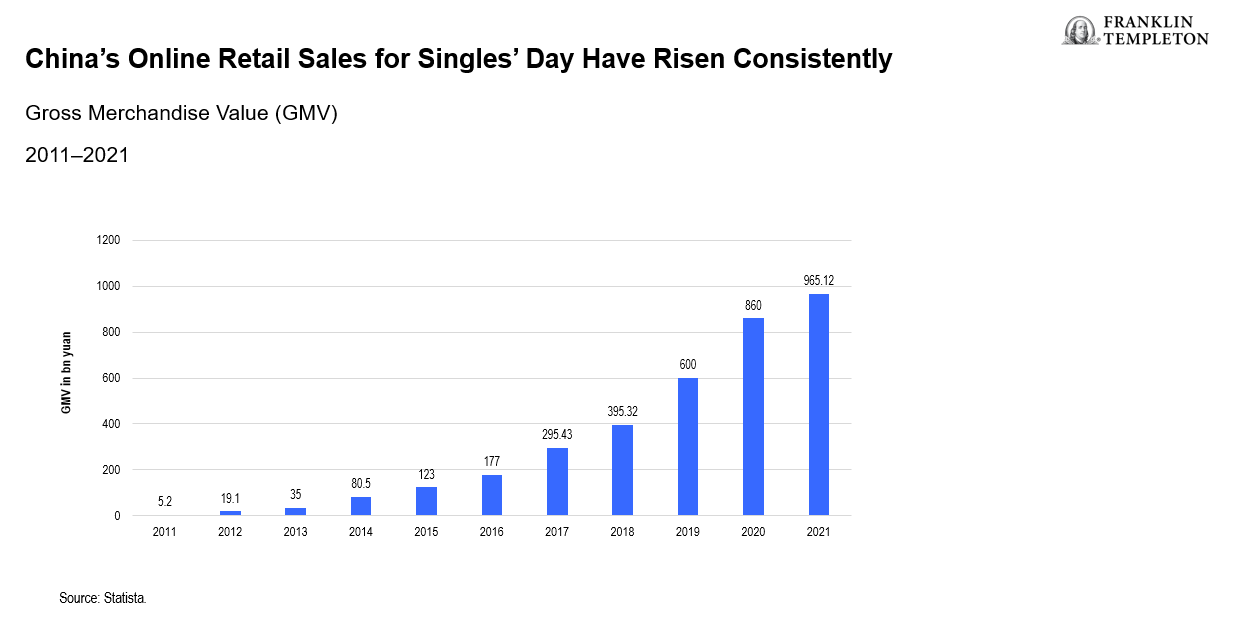

- Online sales of physical goods for August rose 5.8% from a year ago, eclipsing the growth rates for each month since March.1 We believe this may bode well for China’s upcoming Singles’ Day holiday, for which sales figures have risen each year for over a decade.

- Unlike most other major central banks, the People’s Bank of China recently slashed key lending rates to help troubled property developers with outstanding loans. As of late September, the yield gap between the benchmark 10-year US Treasury bond and its Chinese counterpart hovered at the widest level since 2007.2

Will Singles Day sales offer an economic spark?

In case you want to mark your calendars, the mid-October pre-sale campaigns to kick off the world’s largest online shopping spree known as Singles’ Day are mere weeks away. Consider it a pre-party of sorts to the annual November consumer event in China that has included live-streamed appearances and shows by global celebrities like actress Nicole Kidman and fashion designer Diane Von Furstenberg. It’s a boost many retailers in China sorely need now as sales have been battered by COVID-19 lockdowns and diminished consumer confidence levels.

But China’s retailers are hardly the only ones grappling with challenges. Major brands like Nike and Lululemon have experienced notable inventory pileups this year while others continue to deal with supply chain snags—making it easy to understand why a second “Amazon Prime Day” 2022 is slated for this fall. But not all the data is dire. China’s official August retail sales and industrial production figures beat consensus expectations. Online sales of physical goods for the month rose by 5.8% from a year ago, eclipsing the growth rates for each month since March.3

Last year, despite slowing growth that stemmed from broad regulatory crackdowns, the country’s largest online retailer reached over US$84 billion in gross merchandise volume (calculated via gross sales, not including discounts or returns), which was an increase of more than 8% over the prior year.4 In fact, Singles’ Day sales figures have actually increased every year since the “11.11” (November 11) holiday started gaining traction nearly two decades ago.

To be sure, the nearer-term issues plaguing China’s economy loom large. Overall economic growth has softened, escalating war tensions in Ukraine continue to plague markets everywhere and China’s property sector still poses a drag. Real estate construction in China, now down 25%, is a decline nearly double that which Japan experienced in the decade following its late 1980s crash.5 In 1990, Japan’s gross domestic product per capita was about 80% of that for the United States. China’s is currently about 28%6—suggesting to us there is ample room for catch-up growth.

But the central government is permitting many municipalities to loosen a range of local restrictions on new home purchases. And unlike most other major central banks, the People’s Bank of China recently slashed key lending rates (more than once) to help troubled property developers with outstanding loans. By comparison US 10-year Treasury yields are now higher than those in China for the first time in over a decade.7

Reasons for longer-term optimism

It is anyone’s guess when China’s zero-COVID measures may be adjusted sufficiently to support a solid economic recovery. But going forward, some China watchers expect that the government will try to relax mobility restrictions with more narrow, localized lockdowns to COVID-19 cases, rather than continue imposing citywide lockdowns. In mid-September, the government ended the lockdown for Chinese megacity Chengdu at the two-week mark, which was far less burdensome than the two-month lockdown that Shanghai residents endured earlier this year. China’s leaders are expected to convene in Beijing on October 16 for the Party’s important twice-a-decade National Congress meeting. The gathering holds particular significance as it has also become a widely watched signal for when China may begin to ease its zero-COVID policy.

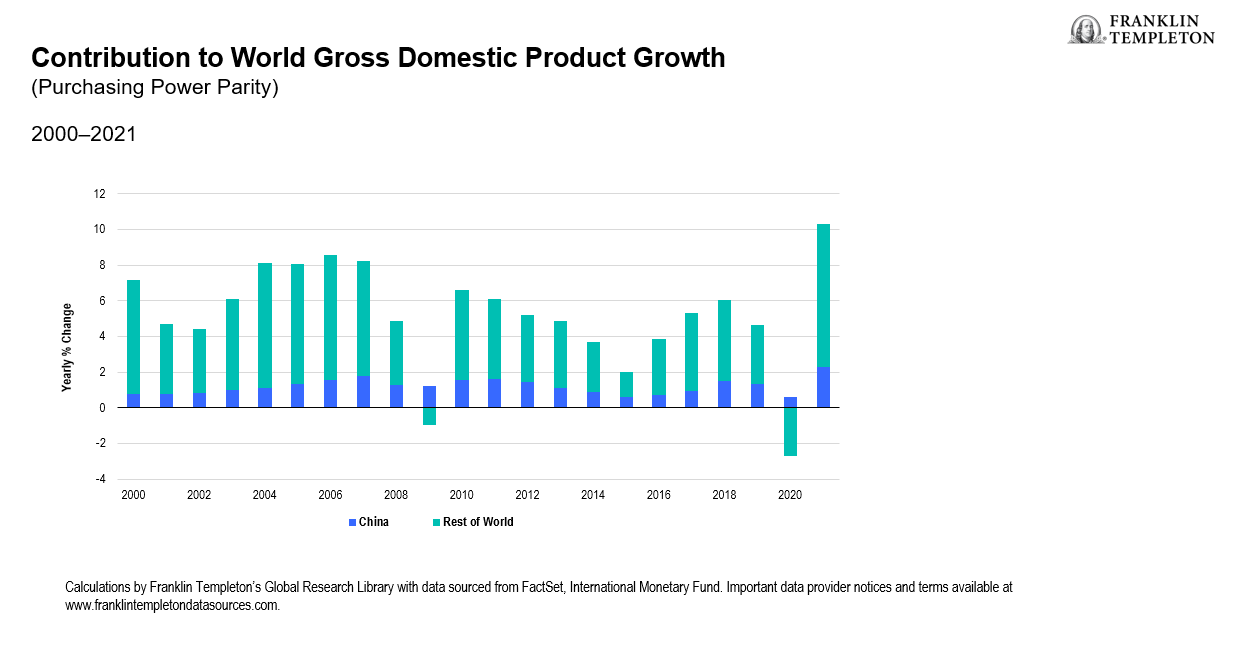

The US dollar’s strength against all major currencies, including the Chinese yuan, may also help make Chinese goods cheaper for foreign buyers, which could be significant for such an export heavyweight. Recent data showed the country’s industrial output has also remained resilient and China accounted for 25% of global economic growth last year.8 In addition, a preliminary report by the International Federation of Robotics shows China’s industrial robotics market achieved strong growth with 2021 installations rising 44% over the prior year.9

Party leaders launched a number of “common prosperity” policies in 2021, including measures aimed at improving clean energy, raising efficiency and reducing emissions. The campaign has been described as a transformational new path for China’s development. It’s worth noting that the world’s second-largest economy now generates more renewable electricity than Europe, and pent-up demand for electric vehicles has also been supported by government incentives.

For investors seeking a market that provides access to companies spearheading the development of 5G networks, China is a known hot spot. The government has prioritized policies to support an extensive deployment of both public and private 5G networks, which should drive demand for chips during a period when China’s semiconductor industry is flourishing.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. Investments in fast-growing industries like the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_______________________

1. Sources: Bloomberg, National Statistics of China.

2. Sources: FactSet, Tullet Prebon Information, People’s Bank of China, US Department of Treasury, Sept. 22, 2022

3. Sources: Bloomberg, National Bureau of Statistics of China.

4. Source: Forbes, “China’s Singles’ Day 2021: Three Questions Answered,” November 15, 2021.

5. Source: Shu, Chang, “CHINA INSIGHT: 25% Drop Needed to End Real Estate Oversupply,” Bloomberg Economics.

6. Source: World Bank, most recent data as of 2021.

7. Sources: FactSet, Tullet Prebon Information, People’s Bank of China, US Department of Treasury, Sept. 22, 2022.

8. Sources: China Securities Journal, September 15, 2022; Bloomberg, National Bureau of Statistics of China.

9. Source: International Federation of Robotics, data as of 2021.

English

English Español

Español