This post is also available in: Spanish

Gulf Cooperation Council (GCC) offer compelling valuations

GCC bonds’ defensive characteristics have stood out to us during a challenging year, demonstrating resilience in the face of interest-rate volatility and a general emerging market bond selloff. GCC bond market declines, as measured by the FTSE MENA GCC, are a little more than half the declines of emerging markets as a whole, as measured by the JPMorgan Emerging Markets Bond Index Global Diversified (JPM EMBIGD).1 The Ukraine and Russia are remote from the GCC, and the linkages are limited. That said, higher oil prices have supported the relative strength of GCC markets. Market volatility has impacted GCC issuance though, with bonds and sukuk down 57% relative to 2021.2 GCC bonds are also losing market share to loans, dropping to 30% from 56% in 2020.3 We expect GCC issuance to end the year below $60 billion, down from a previous estimate of $90 billion.4

The Kingdom of Saudi Arabia (KSA) is rapidly developing its bond markets. Saudi Arabia today represents 52% of GCC bond markets, up from 18% in 2015. It is currently on track to unseat Malaysia as the largest issuer in global sukuk markets, with 36% of global sukuk issues.5 The transition to low carbon will persist as a theme, and the GCC has stepped up its commitments and started funding projects that should diversify the region’s energy mix and reduce oil and gas production emissions. We believe these developments are very welcome and will create enormous sustainable financing needs, estimated at over $200 billion by 2030.6

The US Federal Reserve remains convinced of a soft landing for the economy, but inflation may realistically only normalize in a downturn with higher unemployment, in our opinion. History offers little comfort from periods where unemployment rises, even by small margins. Few markets, if any, are currently priced for that risk, including global sukuk and GCC bond markets. Providing some comfort, however, is that absolute yields for GCC bonds are approaching the highest levels in 20 years, excluding the global financial crisis. We see current valuations as compelling, particularly for higher-quality issuers. Despite the risks, or rather because of the abundance of risk, we believe higher-quality, fixed income assets are poised to better defend portfolios, especially those with active mandates.

The GCC region remains resilient

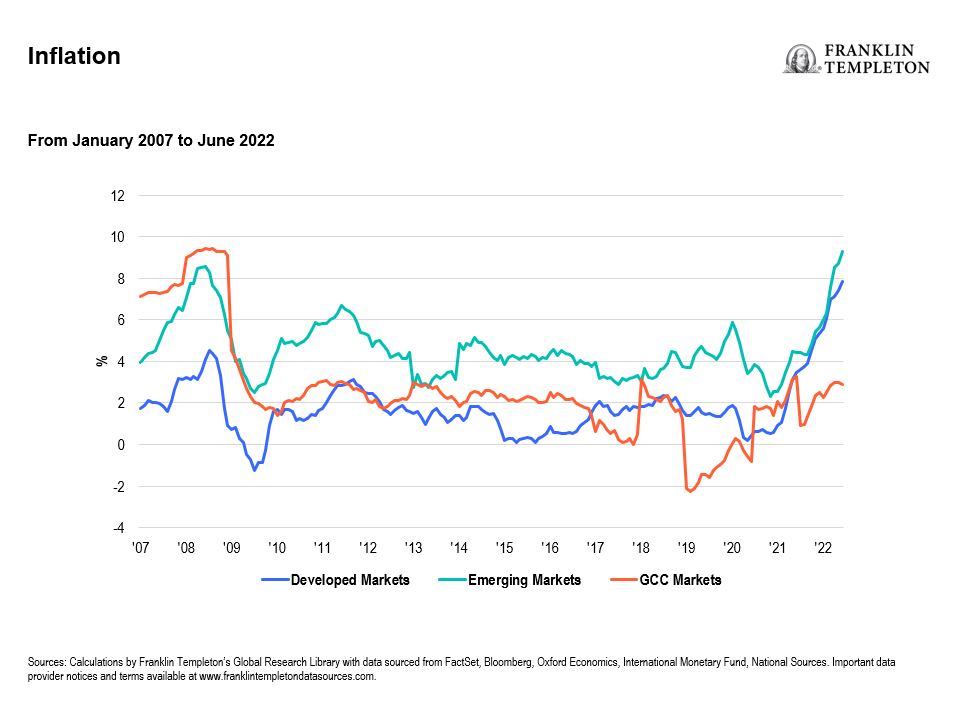

GCC economies continue to be resilient amid global uncertainty. Buoyed by higher commodity prices, robust balance sheets and a steady growth outlook, inflationary pressures and growth prospects remain well balanced in the region, in our view. The International Monetary Fund (IMF) has been revising up its inflation forecasts, and its 2022 estimates now stand at 6.6% for advanced economies and 9.5% for emerging markets and developing economies. While GCC economies also have witnessed a pick-up in inflation, it remains relatively tame due to a stronger USD and regulated pricing and subsidies in many GCC economies. The GCC region’s inflation forecast is 3.1% for 2022.7

We highlight that GCC economies have undergone critical fiscal and social reforms over the past five years to diversify their finances and attract foreign investment. Despite solid efforts on balancing budgets, regional governments have kept their long-term focus on economic growth with large capital expenditure plans remaining on track. We anticipate higher oil prices will likely alleviate the debt burden of some of the more challenged economies in the GCC region. For countries like Saudi Arabia, higher oil prices significantly boost the government’s ability to pursue its growth and diversification agenda without materially deviating from fiscal consolidation goals. We believe valuations in Saudi Arabia remain elevated versus historical averages, and ample liquidity and continued investor optimism offer support. In our analysis, market performance going forward will likely be contingent on an improving earnings outlook, which would support these higher levels.

The GCC’s corporate earnings outlook remains robust for the remainder of 2022, buoyed by higher oil prices and improving demand. The GCC banking sector continues to be a key beneficiary of rising interest rates and a robust growth outlook for the region. We expect improving margins and stronger lending to support GCC banks.

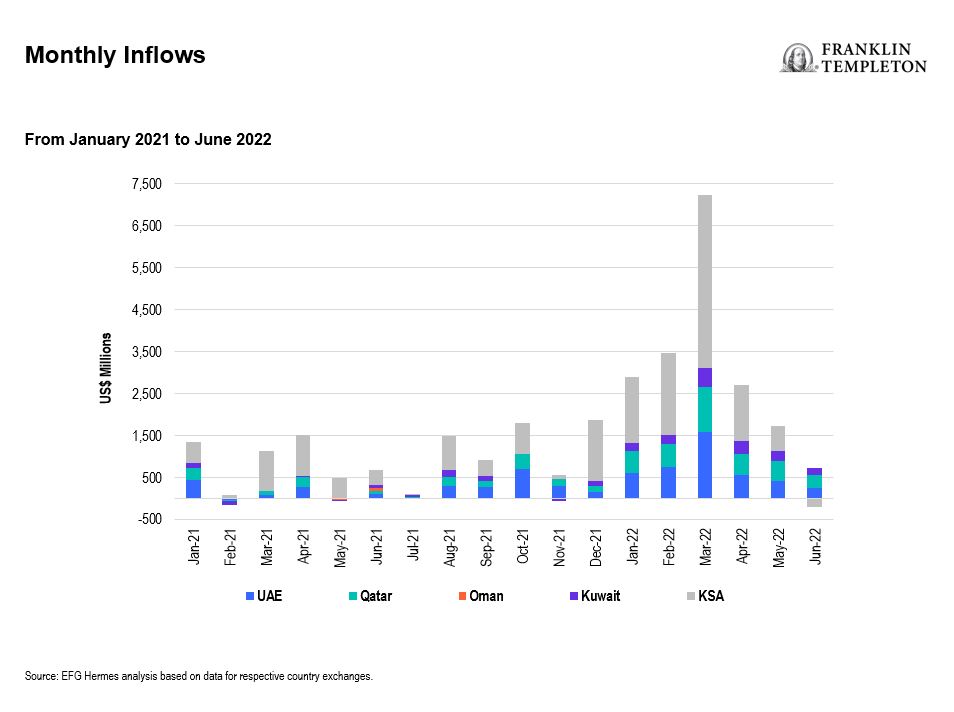

The liquidity story in the GCC region is potentially still in its early chapters. The weighting of the region in global emerging market indexes has steadily increased over the past five years to 7%-8%, and we expect it to rise to more than 10% in the medium term, driven mainly by foreign ownership limit removals in Saudi Arabia and the United Arab Emirates (UAE) as well as expected initial public offering (IPO) inclusions.8 Investors’ positioning in the GCC is increasing, yet remains low, although high energy prices, ongoing market reforms and a healthy IPO pipeline could attract further active flows into the region. The GCC’s IPO issuances is experiencing a standout year in 2022, amid a sharp economic recovery, a rebound in oil prices, a pickup in overall sentiment and a continuation of critical reforms.

We believe this year is shaping up to be one that builds on the successes of 2021, further broadening the GCC investment universe and expanding companies’ access to capital markets. Strong post-listing performances should continue to provide the needed momentum to push forward more IPOs in the pipeline.

In summary, despite macroeconomic headwinds, we believe opportunities may be found in GCC bond and equity markets.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (FT) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Bloomberg, as of September 6, 2022.

2. Source: Ibid.

3. Source: Ibid.

4. Sources: Franklin Templeton estimate based on Bloomberg data, September 2022. There is no assurance any estimate, forecast or projection will be realized.

5. Source: Bloomberg, September 2022.

6. Sources: Bloomberg NEF, Bloomberg Terminal; forecasts from FTIMEL. USD187 bn investment planned by KSA up to 2030 and USD160 bn planned by UAE up to 2050.

7. Source: IMF WEO, April 2022.

8. Source: EFG Hermes, as of September 2022.

English

English Español

Español