Three things we’re thinking about today

- China’s reopening and impact on energy prices. China’s economic reopening is proceeding swiftly, despite the spike in COVID-19 cases in early January. Investor attention has recently switched to the reopening’s impact on energy prices. In contrast to Europe, China is experiencing a bitterly cold winter, with average temperatures 15ºF below average for the month of January.1 This is increasing demand for natural gas, the majority of which China imports from overseas. Liquid natural gas (LNG) prices in Asia and Europe have not yet reacted to the frigid weather in China, as Europe is experiencing temperatures on average 15ºF above average over the same period.2 However, if this were to change, LNG prices could rise, reigniting global inflation concerns and limiting China’s room for fiscal maneuvering given gas subsidies provided to households.

- Markets pivot toward growth. January witnessed a dramatic shift in the performance of growth stocks, with the MSCI Emerging Markets Growth Index posting double-digit returns.3 Value stocks witnessed positive performance but lagged behind. This is a reversal of the 2022 performance trend, wherein value stocks performed better than growth stocks as rising interest rates undermined the outlook for the latter. Looking ahead, the likelihood of a continuation of this January’s trend will likely be dependent on the direction of interest rates and the US dollar, among other factors.

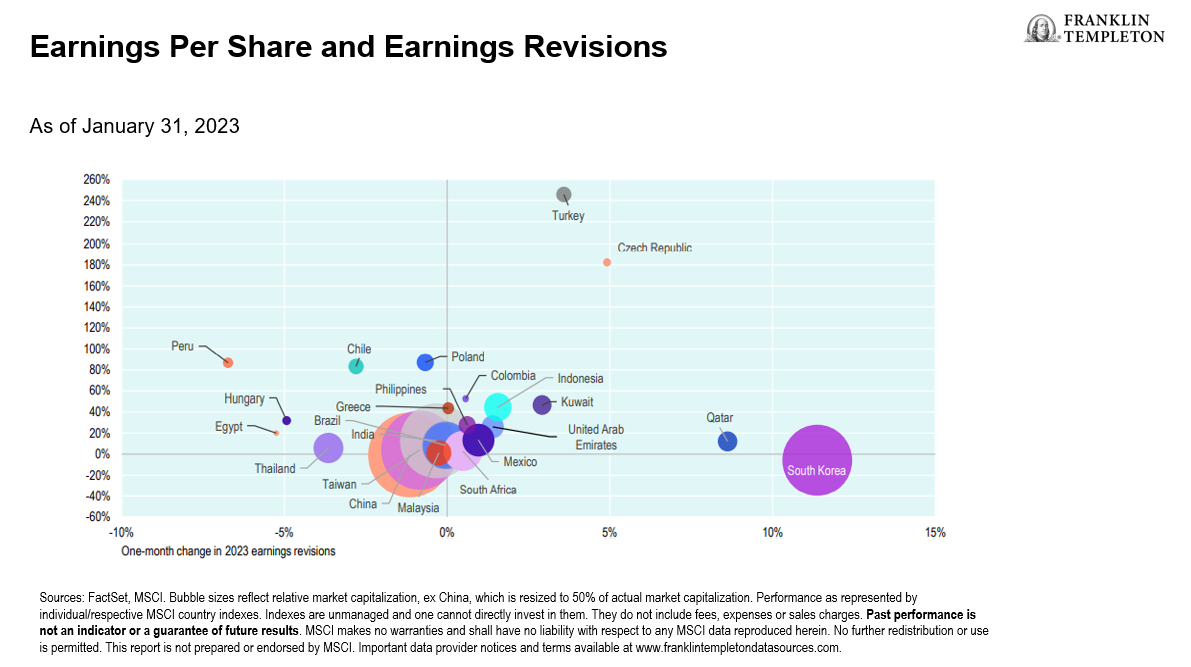

- Emerging markets (EM) earnings outlook. Consensus expectations are for a recovery in emerging market earnings in 2023, following a sharp decline last year.4 China’s reopening and economic recovery is expected to drive earnings, particularly in the financials and consumer discretionary sectors. High interest rates typically benefit banks, and a recovery in consumer technology business prospects looks likely to us, including e-commerce.

Outlook

The prospect of weaker external demand has led policymakers in EMs turn to domestic demand, in particular consumption, to shore up economic growth. For example, South Korea plans to offer large tax breaks to semiconductor and other technology companies investing within the country. The country is also planning to make investing in the local stock market easier for foreign investors and is providing subsidies for citizens to cope with increasing prices. Thailand has also approved a budget to boost tourism in the country, one of its biggest growth drivers.

The long-term structural tailwind of EM consumption growth via expansion of the middle class and premiumization of buying patterns is now more significant than ever, in our view. The Chinese consumer opportunity is under the spotlight following the country’s economic reopening. Some US$2.6 trillion in Chinese bank deposits were amassed in 2022[5]—and middle-class households are looking to draw down these saving to spend on experiences, products and services. This is driving the premiumization trend opportunity at the heart of the EM consumption story we see.

Other opportunities that look to boost EM growth besides Chinese consumption abound. For example, a surge in initial public offerings in the Middle East should help drive consumption via a trickle-down wealth effect. We believe these uncorrelated drivers of returns in EM economies present an investment opportunity which our team’s deep experience, local expertise and a bottom-up investment approach are poised to uncover.

While this is a time of uncertainty, we continue to stress the importance of taking a long-term view and undertaking due diligence in making investment decisions. With over 30 years of experience in EMs, we are no strangers to market uncertainties and are experienced in investing through highly volatile periods, which we believe has helped us remain calm in the current market environment. We recognize that this period will pass, with history having shown us that markets should eventually stabilize and recover.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. Investments in fast-growing industries like the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

______________________

1. Source: Climateengine.com

2. Ibid.

3. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

4. Source: Bloomberg, as of January 31, 2023. There is no assurance any estimate, forecast or projection will be realized.