Key takeaways

- Improving domestic fundamentals and global outlook paint a brighter picture for China

- Geopolitical tensions remain at the top of investors’ concerns

- US-China trade data show resilience against a long-deteriorating relationship

- We see potential opportunities in government support, a tech recovery, and climate transition

- The stark rally in Chinese equities looks set for a breather, not a reversal

Chinese equities have staged an impressive comeback since hitting multi-year-lows during the third quarter of last year. In October 2022, the broad FTSE China 30/18 Capped Net Index fell to nearly 10,000 points, a level not seen since the aftermath of the bursting of the 2015 speculative bubble, and some 23% below its 2018 US– China trade war trough.1 A friendlier sentiment for risk assets globally, along with a reversal of China’s zero-COVID approach and increasing hope for a soft(er) landing of the US economy have subsequently propelled the market some 60% by the end of January of this year.2 Chinese equities have also been trading above their 200-day moving average3—a key technical level—for the first time since the summer of 2021.

However, tensions between the United States and China have been and remain elevated, with several direct and indirect unresolved disputes between the two superpowers. Against this backdrop, more volatility is likely in store, but the longer-term prospects for equity investors in China continue to improve. We believe that the recovery rally we have witnessed in Chinese shares since late last year has further to go.

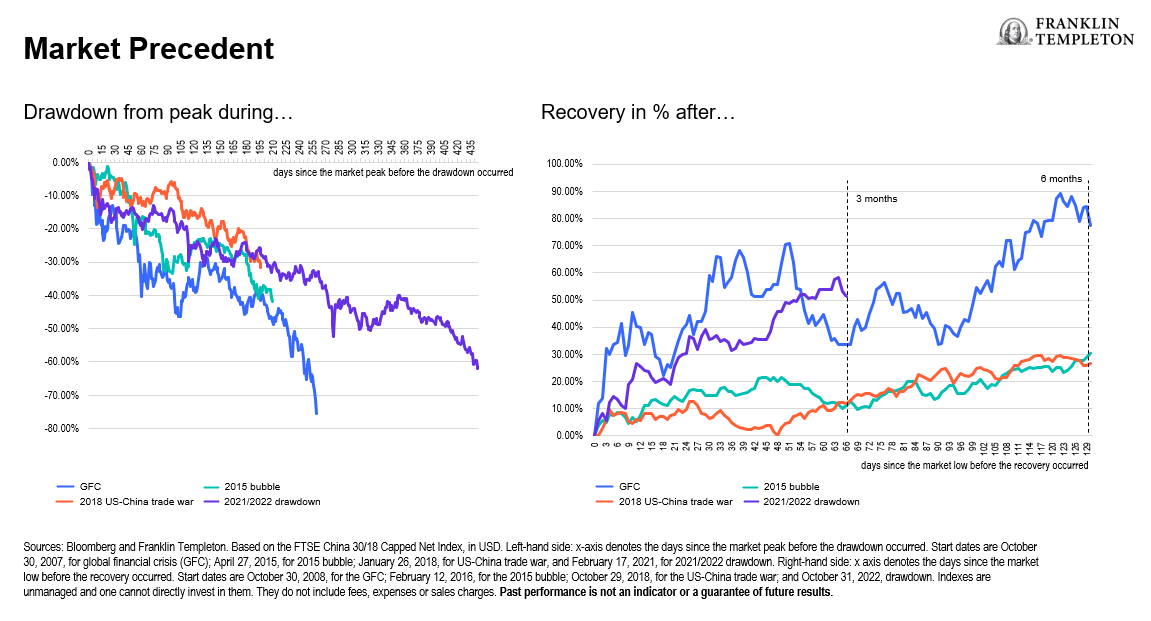

First, while potentially over-heated in the short run, extended rallies after hefty declines are nothing uncommon in Chinese markets. Looking at the past three major drawdowns before 2021—the global financial crisis (GFC), the bursting of the 2015 bubble, and the aftermath of the US-China Trade war in 2018—we can see that, in hindsight, the 2021/2022 episode lasted far longer than any of those prior bear markets. More than that, Chinese equities retreated more than 60% from their all-time-high, a value only eclipsed by the 75% loss during the GFC. The other two instances lasted less than half as long and were less severe in terms of losses (30%-40%). Hence, taking the GFC as the only justifiable precedent to what we have seen recently, we argue that the current bull market—now roughly three months in—could grow quite a bit further. After the GFC low, for instance, markets very quickly rallied approximately 70% before pulling back to +35% at the three-month mark. After just six months, however, gains had already extended to 80%-90%.4 We currently see some of the most beaten-down index heavyweights, including technology and consumer behemoths Tencent and Alibaba, experiencing the sharpest comebacks (up 99% and 71% from their respective lows).

Reopening, fiscal and monetary support

Second, and as we have argued before, Beijing has more levers at its disposal for economic support than its counterparts in most developed countries. A prime example is its recent policy pivot away from its zero-COVID policy. While the reopening will continue to pose challenges and encounter road bumps along the way, it represents a major positive shift for the economy nonetheless. As domestic and international tourism and manufacturing picks up, some neighboring countries—including important trade partners like Korea—will also be affected, potentially leading to a positive reinforcement loop. A perhaps even more impactful example going forward is central bank policy. Contrary to Western counterparts, China’s central bank has been on an easing path for some time, and inflation expectations remain moderate for 2023. Consensus forecasts see inflation at 2.7% for the first quarter and tapering off to 2.0% for the last quarter of the year.5It remains to be seen if and how this will change as the local economy gears up, but compared to the situation in the United States and Europe, China and the People’s Bank of China’s (PBOC’s) policymakers arguably are in an enviable position.

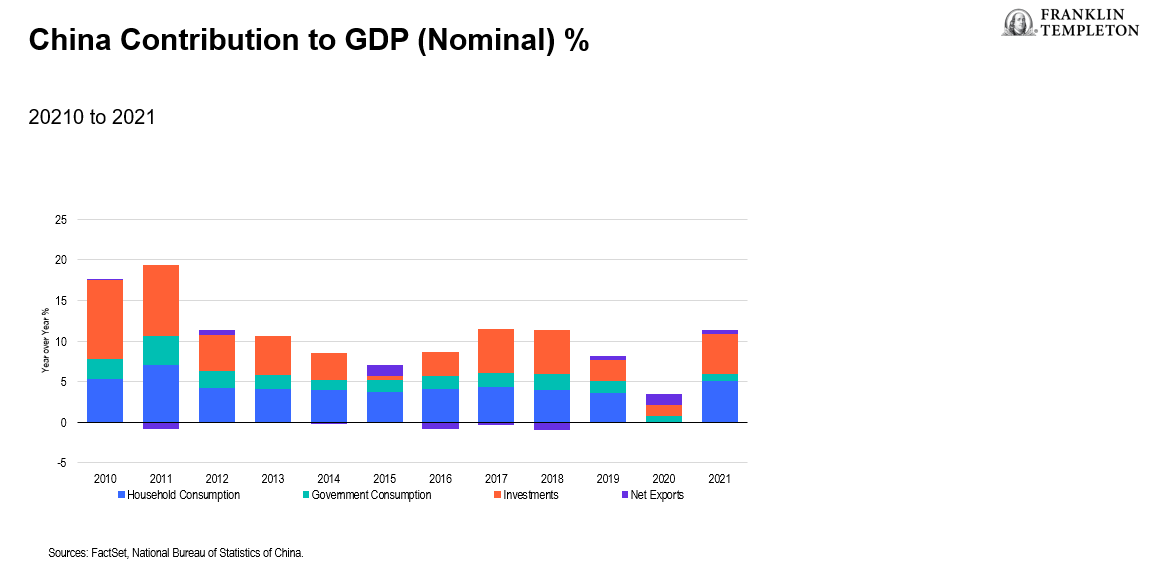

In January, local governments further expanded their special bond issuance to 643.5 billion yuan for the month, up almost a quarter from last year’s figure and another sign of the government’s commitment to help shore up the economy through infrastructure investment.6 It is worth noting that, while still critical, the gross domestic product (GDP) shares of investments and government consumption have tended to decline over the past decade, while the importance of household consumption has grown. The latter tends to be a relatively less volatile driver of growth, which bodes well for the longer-term prospects. Coming out of last year’s pronounced economic slump, however, we view government action as indispensable to boost growth fast.

Overall, the central government, local authorities, and the PBOC have pledged their willingness to support the economy numerous times. And compared to 2021 and much of 2022, we think that a noteworthy shift has occurred: the pledges are usually backed by action.

Geopolitics, the US-China relationship, and climate change

The bilateral relationship between the United States and China has been strained for some time. It arguably hit a low point most recently with US Secretary of State Antony Blinken’s postponement of a trip to Beijing. However, there have been encouraging signs of improvement, too. One is the fact that a Blinken visit to China was—and still is—on the cards in the first place. Another is a recent meeting between US Treasury Secretary Janet Yellen and China’s Vice Premier Liu He in Zurich, which itself came in the tracks of a Biden-Xi summit just two months ago in Bali.7 Diplomacy is ramping up, certainly compared to the Trump era, even though actual US policy toward China remains tough. This includes export restrictions of advanced US technology like semiconductors and equipment. Amidst all this, it is important to keep things in perspective. Despite the 2018 trade disputes, a global pandemic, the war in Ukraine, heated rhetoric around myriad geopolitical concerns, and much talk about decoupling: the interdependence of the largest and second-largest global economies has, so far at least, mostly grown. In 2022, US-China trade soared to a record US$691 billion, including a 6.3% increase of Chinese imports into the United States.8

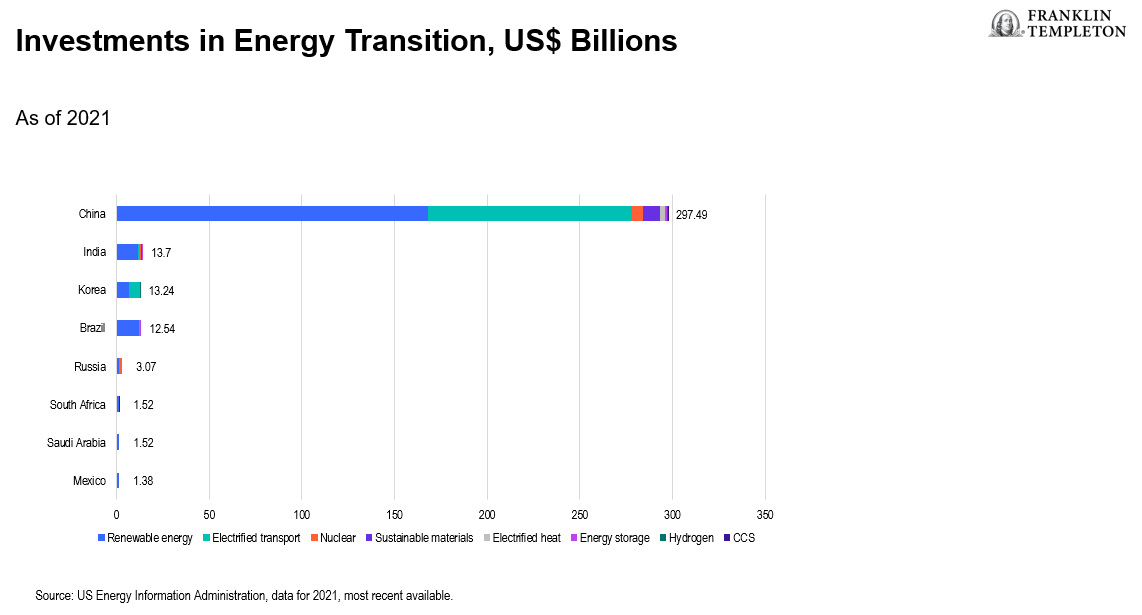

An opportunity for further cooperation could be climate policy. It represents an area for China to lead the world as an indispensable player together with the United States, which is equally critical as the largest emitter of greenhouse gases. Under President Biden, the US placed a premium on progress on the issue.

China, meanwhile, produces 97% of the world’s solar wafers, 85% of photovoltaic cells and 79% of solar panel polysilicon, and is currently weighing export restrictions on some crucial components of the solar energy supply chain.9 In 2021, China invested some US$278 billion in renewable energy projects and electrified transport alone; on top of that came smaller sums for sustainable materials, energy storage and other related components.10 For better or worse, global cooperation over climate change solutions is practically unavoidable, but it may present an opportunity to literally “lower the temperature” on other issues as well.

Emerging markets are where it’s at

More generally speaking, we view Asian markets as well-positioned for the year ahead—despite the need to tread carefully and remain nimble. A potentially softer-than-feared landing in the United States and receding inflation in Europe would be a boon first and foremost for Americans and Europeans, but it would most certainly also benefit important export economies like China, Japan, South Korea and Taiwan.

Case in point: just last month, the International Monetary Fund (IMF) lifted its 2023 growth forecast for China by a whopping 80 basis points to 5.2%, with the strongest quarter likely to be the second as the reopening effect will fizzle later in the year. India is forecast to grow at over 6% both in 2023 and 2024. Combined, more than half of global GDP growth this year will come from just those two nations.

Emerging markets are both an important contributor to and a beneficiary of more resilient global growth and should outgrow developed markets for some time to come. Climate transition investments will remain a cornerstone of their success. In China, that can be an additional boost for some index heavyweights that already tend to be advanced. That is not to say that there aren’t challenges ahead. China’s declining population will pose a headwind for years to come. Political and other idiosyncratic risks are often more pronounced in emerging than in developed markets. Foreign exchange dynamics can impact investor outcomes substantially (in both ways). From a growth lens, however, we like the current constellation in China specifically, with reopening push, moderate equity valuations, a more favorable political situation than last year, and long-term opportunities like the energy transition.

We think that the market’s current optimism is underpinned by better fundamentals, not flimsy hopes, and that the rally may be set for a breather, but not a reversal.11

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies; investments in emerging markets involve heightened risks related to the same factors. Investments in fast-growing industries like the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. The FTSE China 30/18 Capped Index represents the performance of Chinese large- and mid-capitalization stocks. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

2. Source: FTSE Russell.

3. The 200-day moving average represents a simple average of the closing price of a stock or index over the most recent 200 trading sessions.

4. Sources: Bloomberg, Franklin Templeton.

5. Source: Bloomberg. Consensus estimates for inflation are: 2.7% in Q1, 2.3% in Q2, 2.2% in Q3 and 2.0% in Q4. There is no assurance that any estimate, forecast or projection will be realized.

6. Sources: Bloomberg, Franklin Templeton.

7. Source: Bloomberg, “A US-China Thaw Gains Momentum in Switzerland,” January 19, 2023.

8. Source: CNN, “US-China trade defies talk of decoupling to high record high in 2022,” February 8, 2023.

9. Sources: IEA, 2022; Reuters, “China ban would slow, not halt, Western solar push,” February 3, 2023.

10. Source: US Energy Information Administration, 2021 data.

11. From a technical point of view, we regard the support levels around 13,300 and at 12,696 as critical to hold. A break beneath would call for a reassessment of the short-term outlook.