Mexico’s domestic stock market has been performing well. Year-to-date, the FTSE Mexico Index is up more than 27%, outperforming the S&P 500 Index’s gain of about 12.5%.1 The post-pandemic alternative supply chain narrative that led to the “nearshoring” trend has already dominated headlines, but what leading sectors are worth examining in this resilient market?

After consumer staples, Mexico’s market has benefited most from materials sector stocks year-to-date. We believe this may be owing at least in part to the country’s new national renewables goal, which could serve it well going forward through job generation, further foreign direct investment (FDI), increased energy security and improved air quality. The country elicited praise during the COP27 United Nations climate change conference in November when it raised its target to unconditionally cut greenhouse gas (GHG) emissions to 30% below usual levels by 2030 (up from its previous target of 22%).

US Special Presidential Envoy for Climate John Kerry pledged to uphold close working relations to help Mexico meet its ambitious new aims. This includes US efforts to mobilize financial support as well as joint efforts to catalyze and incentivize investments into new Mexican renewable energy deployment and transmission. Mexico’s preliminary investment plan includes up to US$48 billion in related investments.2

Of course, Mexico is not without its challenges. It remains among Latin America’s two biggest emitters of GHG (Brazil being the other) and President Andrés Manuel López Obrador’s (AMLO’s) moves have sometimes drawn criticism for upsetting investor confidence. AMLO has been accused of curtailing some clean energy policies, attempting to increase the government’s grip over business and making voting more difficult, reducing trust in elections. However, AMLO is in the home stretch of his term, which ends in September 2024. General elections are scheduled to be held next July. While the current ruling party has been faring well in preliminary contests, its victory is not assured.

Cement innovations

An industrial powerhouse that is a major contributor to Mexico’s stock market returns year-to-date has been making some noteworthy moves. As one of the world’s largest makers of building materials, it leads the way in the global testing of various carbon capture methods for the cement industry, with the European Union and the US Department of Energy co-financing projects. It is also innovating in the energy-intensive cement sector to utilize solar power and alternative fuels made from waste and sewage in manufacturing. The multinational announced plans earlier this year to transform carbon dioxide (CO2) from one of its facilities in Spain into more sustainable fuels, such as green methanol intended for the shipping industry. Along with its new carbon capture technology, the green fuel efforts may present a more scalable method of decarbonizing supply chains.

Even more than air travel, the production of cement is a major source of global GHG emissions.3 Here’s a memorable way to think about this: If the cement sector were a nation, it would be the world’s third-largest emitter of global GHG. China leads in the unwanted distinction as the world’s largest emitter, with about a 31% contribution to global GHG emissions.4 The United States follows at nearly 14%, and, while fossil fuel-burning modes of transportation generate among the largest shares of GHG emissions, the aviation industry’s contribution is less than 3%. But global cement production claims roughly an 8% share of global GHG emissions.5

The good news is that the world’s top cement producers, including Mexico’s Cemex, now have a robust pipeline of 37 total carbon capture projects, up from just two in 2019.6

Opportunities and headwinds

While Mexico is one of the largest oil producers in the Western Hemisphere, it is far from a commodity-dependent economy. It boasts one of the region’s most-developed manufacturing industries, holds solid commitments to free trade and, as previously mentioned, enjoys nearshoring advantages for its proximity to the United States.

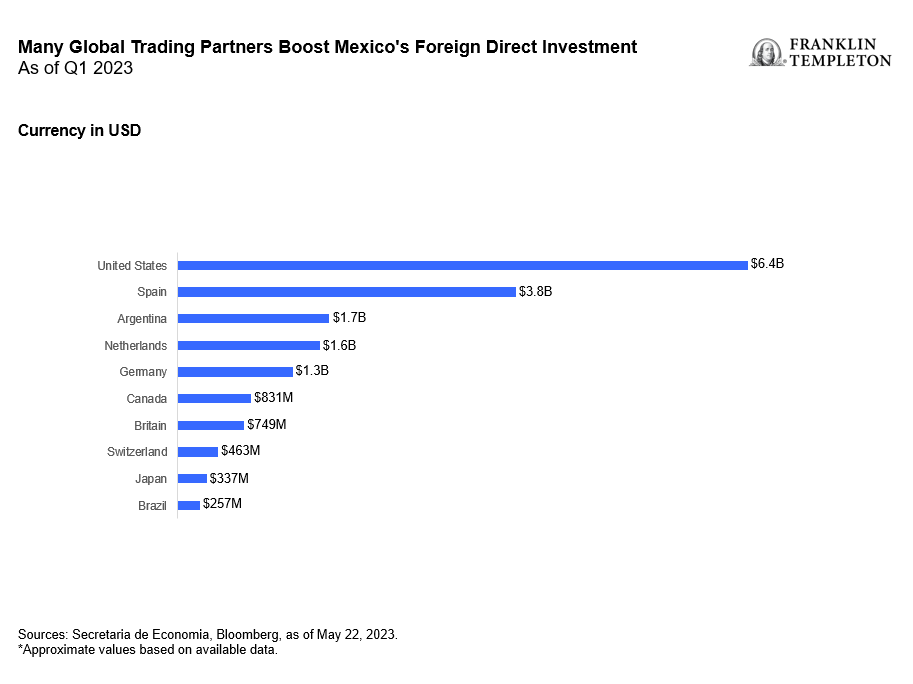

A strong marker of recent corporate nearshoring is the increased FDI Mexico attracted during the first quarter of the year. FDI rose 48% from regular flows recorded during the same time last year. Investment swelled to US$18.6 billion from January 2023 through March 2023, according to data from Mexico’s Economy Ministry released in late May.7

International tourism also rose nearly 8% in March compared to the same time last year for the country, which is home to a vast young and skilled population.8 In addition, growing demand for electric vehicles could also make Mexico a magnet for more green investment. For example, Tesla recently announced plans for a new vehicle assembly plant south of the border. Further expansion could help make the country a key player in the development of lithium and lithium-ion batteries, and prompt Mexico to undertake more mining projects.

Investors seeking targeted exposure to a broad swath of companies in Mexico, including its notable materials and autos-related segments, can consider single-country exchange-traded funds (ETFs) for flexible and low-cost access to the country’s equities.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested.

Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in developing markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Commissions, management fees, brokerage fees and expenses may be associated with investments in ETFs. Please read the prospectus and ETF facts before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Bloomberg, as of June 9, 2023.

2. Source: US Embassy & Consulates in Mexico, November 14, 2022.

3. It should not be assumed that any securities transactions were or will be profitable. The analysis and opinions of the security discussed herein may change at any time. There is no assurance that any security purchased will remain in the portfolio, or that any security sold will not be repurchased. Factual statements are from sources deemed reliable but have not been independently verified for completeness or accuracy. This example may not be relied upon as investment advice or recommendations or an offer for a particular security or as an indication of trading intent.

4. Source: Statista 2023.

5. Source: Chatham House Policy Institute, as of 2018.

6. Source: Bloomberg, as of April 5, 2023.

7. Source: Bloomberg, as of May 22, 2023.

8. Source: National Institute of Statistics and Geography (INEGI).