The country

Indonesia is the most populous country in Southeast Asia and its largest economy, and also represents the world’s third-largest democracy. The composition of the economy is roughly 42% industry, 42% services and 12% agriculture.1 The country has a long-established global position in the production and processing of raw commodities such as coal and palm oil.

The elections are only the fourth since independence in 1945

This year’s Indonesian elections are the largest in the world in terms of the number of citizens voting on a single day. On February 14, approximately 205 million voters will select the next president and the representatives in the legislature (in Indonesia, serving members of the armed forces and police are not allowed to vote). If no candidate achieves the 50% plus one vote threshold to win outright, there will be a second round between the top two candidates on June 26. All 671 legislative seats will also be up for grabs in Indonesia’s bicameral system. Thousands of provincial and local level offices will also be contested.

According to the latest LSI Denny JA poll on January 30, Prabowo Subianto (commonly known as Prabowo) leads at 50.7% with the other two candidates behind at around 20% each, with Anies Baswedan trailing slightly.2 Prabowo ran and lost against Joko Widodo (known as Jokowi) in 2014 and 2019.

What does it mean for investors?

Investors appreciate the country’s disciplined macroeconomic policies. The steady increase in exports of processed metals means external deficits are unlikely to spiral out of control. Meanwhile, its improved infrastructure has helped limit logistics costs, thus helping control inflation. As is normal in election campaigns, there is much talk of higher social welfare payments, which could potentially pressure the fiscal deficit, but the candidates also talk of tax reform to increase government revenues. Some are preoccupied by the government’s ban on exports of nickel and bauxite, which are effectively incentivizing onshore processing of the minerals, to capture more of the added value in production and promote local supply chains.

It seems likely that regardless of the election outcome, Indonesia will be able to continue to balance relationships with China and the United States, while being well placed to build a key position in the new architecture of global supply chains, based around its critical mineral resources. Setting aside the different gross domestic product (GDP) trend growth targets of the candidates, which range from 5.5% to 8% per annum, the key variation looks to be the degree of divergence from the Jokowi-era policies, depending on the winning candidate.

One important issue that construction companies and private-sector infrastructure investors are watching is whether the current administration’s project to move the capital from Jakarta to a new city called Nusantara on Borneo Island will actually happen. Jakarta is home to 11 million people, of which a third do not have access to piped water. So, they rely on illegal wells drilled into the subterranean aquifer. The result is unsustainable water level depletion from illegal wells and regular subsidence. Jakarta is sinking fast—in some parts of the city, this depletion has resulted in a 16 foot (4.9 metres) subsidence in the last 25 years.

The candidates

The polls indicate that Defense Minister and ex-General Prabowo Subianto is in the lead with a 20-point gap, but may not reach the 50% threshold, triggering a second round against either Anies Baswedan (ex-governor of Jakarta) or Ganjar Pranowo (ex-governor of Central Java). It is difficult to predict the winner, as over 60% of eligible voters are under 40 years of age—meaning that inflation control, jobs and corruption are key issues.

Of these, Prabowo appears to be the one most likely to stay close to (incumbent) President Jokowi’s policies. He backs the move of the capital away from Jakarta, the drive to energy independence via greater use of biodiesel and bio gasoline, and developing Indonesia’s upstream minerals processing sector.

Ganjar emphasizes the need to crush corruption, modernize agriculture and to lower interest rates for micro-, small- and medium-sized companies, to boost job creation. He has committed to the completion of the new capital in Nusantara.

Anies has campaigned promising to focus on job creation, with a preference for labor-intensive industries like agriculture, manufacturing and livestock farming, over capital-intensive nickel smelting, for example. He is also against the creation of the new capital in Nusantara, which he dismisses as too costly.

All three candidates are committed to the modernization and upgrading of Indonesia’s armed forces, including investing in cyber security; Anies is the only one publicly against joining the “Quad” (the loose alignment of the United States, India, Australia and New Zealand), as he believes in non-alignment. Prabowo is the most vocal on investing in a blue-water navy (one capable of projecting across the world), to better defend against potential incursions.

Most observers expect Prabowo Subianto, chairman of the Great Indonesia Movement Party (Gerindra) and the incumbent defense minister, to eventually win. He is supported by his running mate, Gibran Rakabuming Raka, the governor of Surakarta and Jokowi’s eldest son.

Prabowo’s likely victory would enable Jokowi to remain highly influential in the new government. It would also position Jokowi’s son Gibran to be Indonesia’s next president in 2029 or 2034, meaning long-term, dynastic ambitions for Jokowi’s family.

Potential market impact

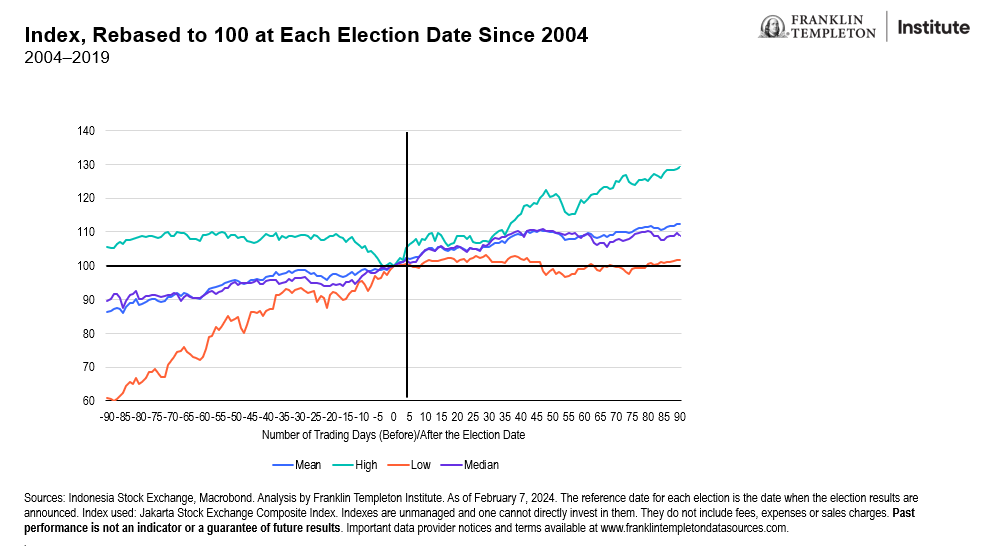

This analysis examines the impact of presidential elections on the domestic equity market, focusing on the 90 trading days before and after election dates, beginning with the inaugural direct presidential election in 2004. Notably, 2004 featured a two-round election process in July and September due to the absence of a candidate achieving the requisite majority in the first round.3 The findings reveal that, on average, the equity market returned +10% return within 44 trading days (roughly two months) following the election date across the four presidential elections observed since 2004, with the exception of the 2014 elections. In the periods leading up to elections, Indonesia’s stock market predominantly exhibited positive returns, except for 2019, when the market showed flat to negative returns.4

Exhibit 1: Indonesia Equity Performance: 90 Days Around Election Dates

Furthermore, the analysis indicates a broader variation in market returns before the election compared to after, suggesting a greater uncertainty among investors prior to the election outcomes. This pattern is visually represented through the dispersion lines in the accompanying charts, highlighting the contrast in market behavior surrounding presidential elections.

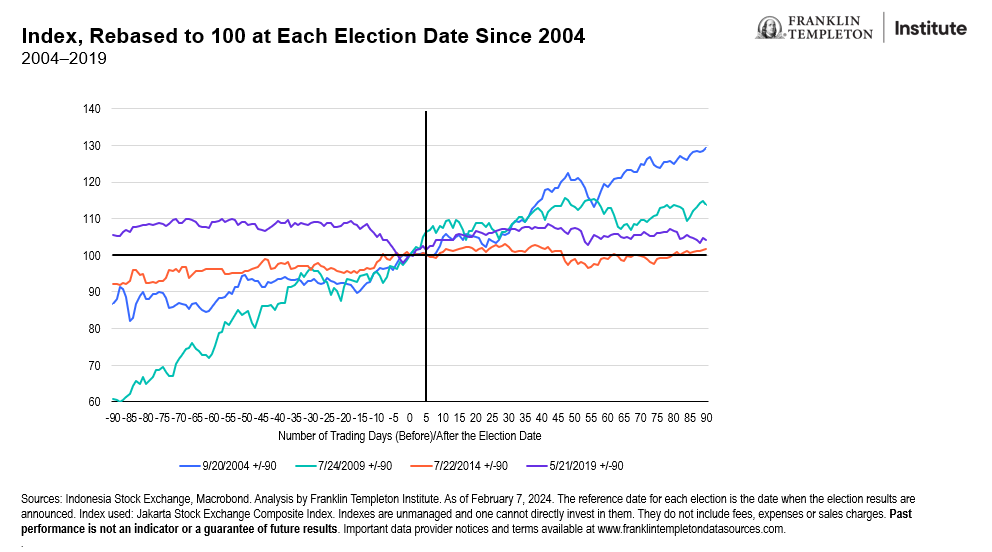

Exhibit 2: Indonesia Equity Performance—90 Days Around Each Election Date

Notes: Below are the election dates. Election results dates were used in the charts.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

____________

1. Source: Statista, World Bank – World Development Indicators. As of 2022.

2. There is no assurance that any estimate, forecast or projection will be realized.

3. This study uses the September 2004 date as the reference point for that year’s election analysis.

4. Sources: Analysis by Franklin Templeton Institute. Franklin Templeton Institute, IDX, Macrobond. Equity returns based on Jakarta Stock Exchange Composite Index. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.