Add a “K-” before most pop culture categories and you’ve probably named a growing South Korean phenomenon. Think K-Pop, K-Beauty and K-Drama, which all fall under the wider catchall terms, K-Culture and K-Wave, or hallyu in Korean. In the 12 years since South Korea’s Gangnam Style sensation caught on globally, world-wide fandom over the country’s cultural exports, or K-Content, has only increased.

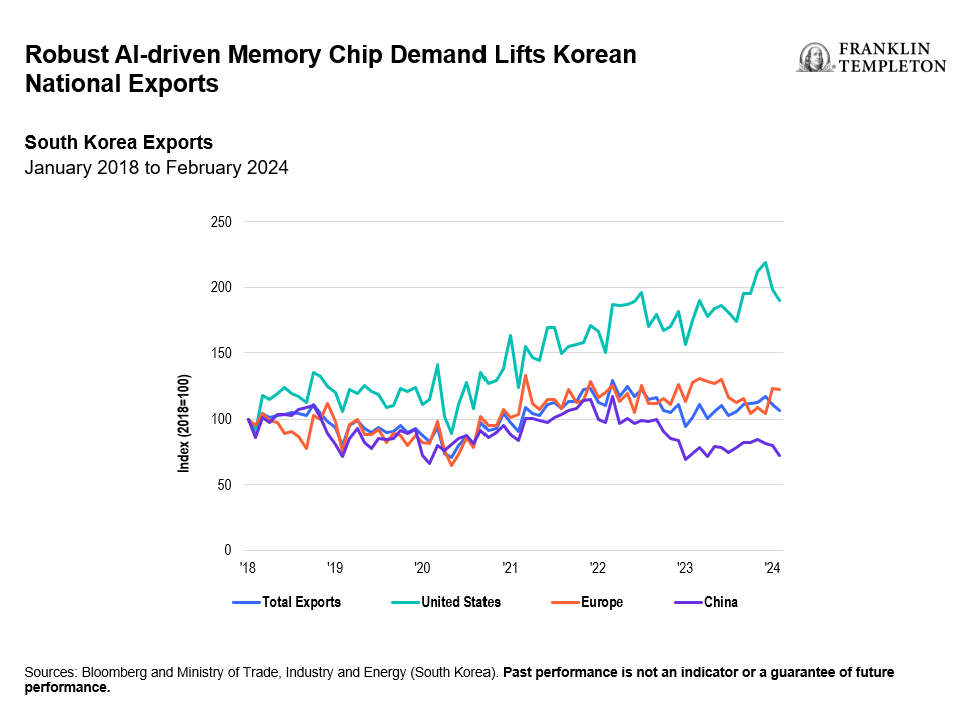

Of course, when it comes to South Korean export prowess, focus tends to fall on the market’s biggest sector—technology—and its star goods: computers and integrated circuits. South Korea’s dominance in heavy industry arenas, such as autos, shipbuilding and chemicals, also command attention. The country’s March export figures grew for a sixth consecutive month, maintaining recovery momentum. While South Korean businesses have met with slower growth from China, increased shipments to Latin America and the United States have partly offset that weakness. Overall shipments to China in March rose 0.4%, while exports to the United States and Latin America rose nearly 12% and 14%, respectively.1

In December, semiconductor exports jumped nearly 22% from a year earlier given the demand for emerging technologies. While China remains South Korea’s top trading partner, exports from Asia’s fourth-largest economy have been lifted by increased chip orders to the United States. Overseas sales of memory chips in March led to a fifth successive monthly rise in exports, up 35.7% and logging the best performance by value in two years.2

Presidential litmus test

South Korean President Yoon Suk Yeol, who promotes a more pro-business agenda compared to his predecessor, faces a test of public sentiment this month during April’s parliamentary elections.

Yoon’s conservative People’s Power Party (PPP) has had to contend with a legislature controlled by the main opposition Democratic Party of Korea, which has limited the president’s implementation of his agenda. If the PPP can secure a majority of the National Assembly’s 300 seats, Yoon should encounter fewer hurdles in making key appointments and pushing through policies during the remaining three years of his single-term presidency and help his party’s prospects for a 2027 presidential election victory.

Despite somewhat unfavorable domestic public opinion of Yoon in recent weeks, the president is credited for improving historically poor relations with Japan on trade and security and has taken aggressive action to strengthen trilateral security cooperation with Tokyo and Washington—a key move as China continues to assert regional influence.

Regulators have been encouraging better corporate governance reform, aiming to narrow the “Korea discount,” which refers to a tendency for South Korean firms to have lower valuations versus global peers, despite robust cash flows and earnings, often due to poor corporate governance and lower shareholder returns. Some two-thirds of South Korean companies are cheaper than their book value. But increasingly, the country’s firms have been taking a page from Japan’s playbook by boosting transparency, share buybacks and dividends to improve shareholder value. This seems to have caught the attention of foreign investors who have helped South Korean equities achieve the best start to a year since at least 1999 in terms of foreign interest, with US$11.7 billion of net buying as of the end of the first quarter of 2024.3 The FTSE South Korea RIC Capped Index rose nearly 21% in 2023.4

Under Yoon’s administration, unemployment has eased more than expected to 2.6%, driven by both manufacturing and services sectors, and remains lower than the 10-year average rate of 3.5%.5 South Korea also ranked second out of 35 Organisation for Economic Co-operation and Development (OECD) member states in a 2023 assessment of mostly rich countries by The Economist that evaluated share prices, gross domestic product, jobs, core prices and inflation breadth.6

“Startup Korea”

Hoping to propel the country into a global startup powerhouse, the government has introduced a new “Startup Korea” plan backed by detailed strategies for the digital economy, inward and outward investment and private venture capital.

Toward this end, President Yoon hosted Meta CEO Mark Zuckerberg in South Korea in February, along with other technology executives, to explore ways to increase cooperation over artificial intelligence (AI) and digital ecosystems in areas such as smart home appliances, wearable devices and smart cars.

Just as South Korea reigns as an exporter of pop culture, beauty and entertainment content (black comedy thriller Parasite made history in 2020 as the first non-English film to win the Academy Award for Best Picture), the image and reputation of its auto brands has also climbed. As recently as 10 years ago, both Hyundai and affiliate Kia were seen as underdogs in the car industry. But that image has shifted. Last year, both carmakers jointly captured the number two slot in US electric-vehicle sales, trailing just Tesla. Analysts say the allied carmakers (both part of South Korea’s Hyundai Motor Group conglomerate), are poised to cement or advance their lead over non-Tesla rivals this year with fresh electric vehicle models and aggressive pricing.

Swifties or ARMY?

New streaming options and social media have helped the popularity of K-dramas and shows such as Squid Game. In 2023, Netflix pledged to spend US$2.5 billion over the next four years in the country as K-drama mania has grown and helped fuel a surge in global subscriptions.

About three-fifths of Netflix’s users have watched a South Korean show, and viewing time for those programs has grown six-fold in just four years, according to Netflix. And in case you thought Taylor Swift was in a league of her own, K-pop boy band sensation BTS has matched her dominance as #1 Global Recording Artist of the Year two years in a row.7

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal. International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Investments in companies in a specific country or region may experience greater volatility than those that are more broadly diversified geographically.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Commissions, management fees, brokerage fees and expenses may be associated with investments in ETFs. Please read the prospectus and ETF facts before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: “Korea’s exports grow 3.1% in March .” The Ministry of Trade, Industry and Energy. April 1, 2024.

2. Source: Ibid.

3. Source: Bloomberg, as of February 27, 2024. Based on the Korea Composite Stock Price Index (KOSPI). Analysis by Franklin Templeton.

4. Source: Bloomberg, April 2, 2024. In US dollar terms. The FTSE South Korea RIC Capped Index represents the performance of South Korean large- and mid-capitalization stocks. Securities are weighted based on their free float-adjusted market capitalization and reviewed semiannually. Past performance is not an indicator or a guarantee of future performance. Indexes are unmanaged and one cannot invest directly in an index. Important data provider notices and terms available at www.franklintempletondatasources.com.

5. Source: “KOREA REACT: Surprisingly Tight Job Market Says No Rate Cuts Yet.” Bloomberg Economics. March 12, 2024.

6. Source: “Which economy did best in 2023.” The Economist. December 17, 2023.

7. Source: International Federation of the Phonographic Industry.