This post is also available in: French, Spanish

- Lula claims third term as president, narrowly defeating incumbent Jair Bolsonaro

- Political divides remain deep, but the government appears balanced by a newly elected pro-market Congress

- Brazilian consumption is on solid footing with upbeat gross domestic product (GDP) growth, lower inflation, improved confidence and scope for rate cuts

- Equity markets and the Brazilian real have trended higher over the past year

- Infrastructure and green projects promise new opportunities for investors

Brazil’s new—and former—President Luiz Inácio Lula da Silva (“Lula”) wrangled 50.9% of the second-round vote to defeat incumbent Jair Bolsonaro in perhaps the most critical election Latin America’s largest nation has seen in decades. Even as Lula delivered his victory speech, with supporters celebrating in the streets and world leaders sending congratulations, Bolsonaro had yet to concede the tight race or make a public address. Thus far, however, there appear few indications that allies and supporters of Bolsonaro, who has long touted baseless claims of vote rigging,1 would push efforts to dispute the results.

Given the narrow outcome, Bolsonaro appears unlikely to roundly admit defeat, and the defeat is by no means a repudiation of his party. A weaker global economic environment, geopolitical and trade tensions, receding commodity prices and domestic issues like the high (albeit falling) debt burden are some obstacles facing Brazil. However, the recent election wins of the pro-market Congress in October should curb some concerns over Lula and his Partido dos Trabalhadores (PT; Worker’s Party), such as a propensity to fund public social spending with debt or higher taxes. Lula himself pledged to run the country as a moderate, recognizing that “the private sector is extremely important.”

While we believe it crucially important for the next government to be fiscally prudent and watch debt levels, markets often tend to reward policies that prioritize investment over spending. Such an approach will also have better odds of being implemented (compared to fiscal giveaways) with the balance of conservative lawmakers and given the Congressional restraints under which Lula will have to operate.

The Lula win comes at a time when, compared to much of the world, Brazil may find support from still-elevated raw material prices and a fiscal surplus. Public accounts have benefited from booming tax revenues and sizeable dividends from state-owned corporates. The central government primary surplus stood at 1% over 12 months (as of September 2022), and forecasts see the debt-to-GDP ratio falling by 4.1 percentage points this year.2

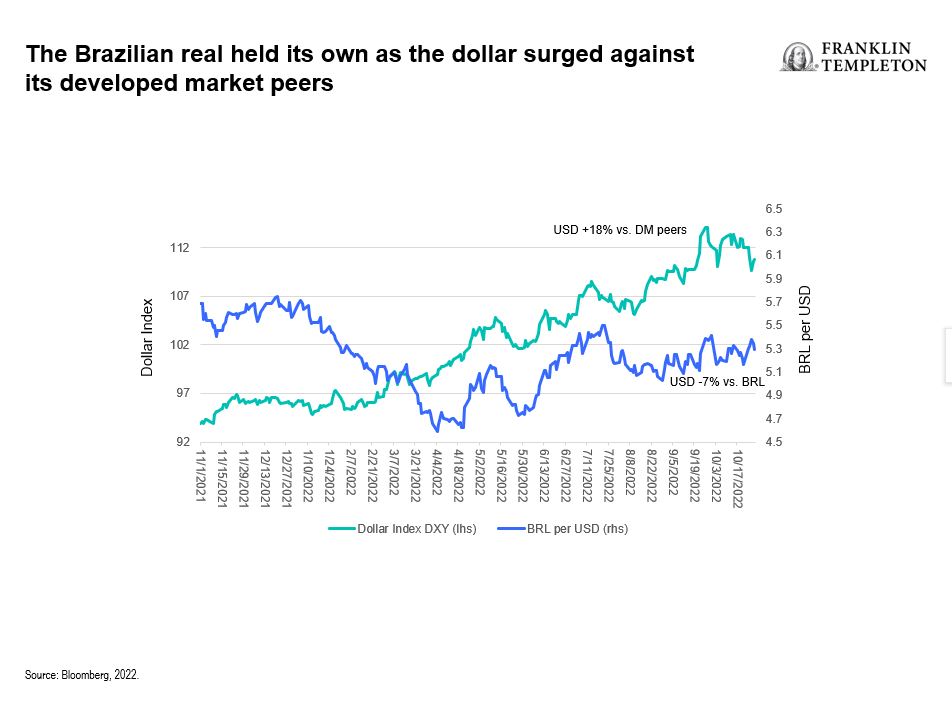

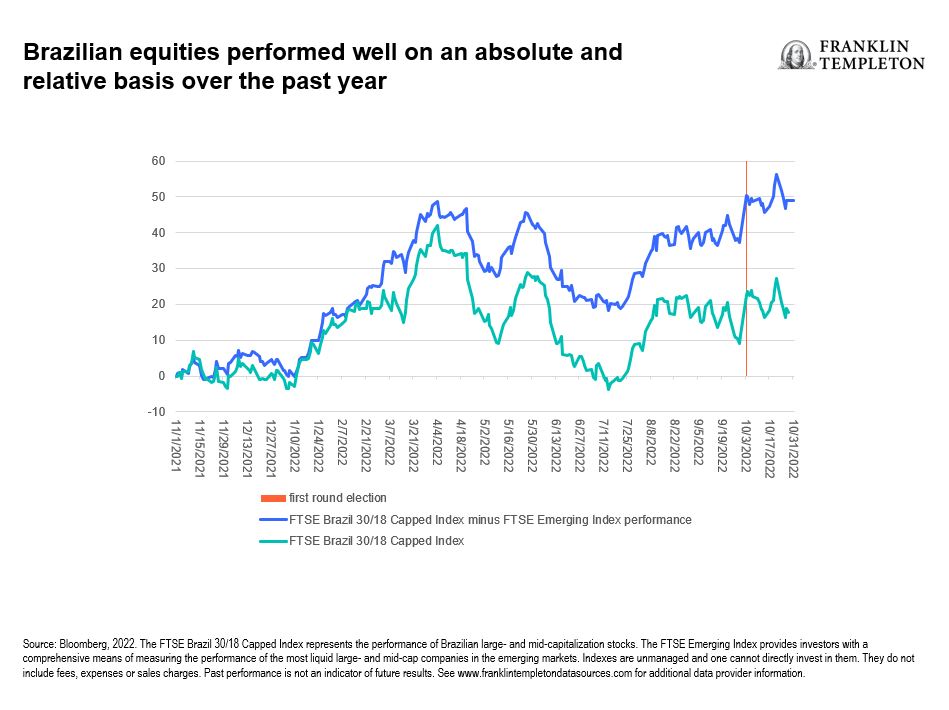

That is a sharp reversal of an upward trend that saw the ratio swell from around 50% in the mid-2010s to nearly 90% in the aftermath of COVID-19.3 While the (current) government expects to return to a deficit next year, and the tailwind from high commodity prices in 2022 may well turn into a headwind, equity markets and the Brazilian real have shown measured confidence. The US dollar is up roughly 18% against major currencies over the past year, but it has retreated against the real. The FTSE Brazil 30/18 Capped Index has gained 19% (in USD terms) over the same time period, a stunning feat given the dismal returns in both emerging market peers (-28%) and developed markets (-18%) alike.4

A phase of disinflation that manifested during the summer has partly driven the optimism, with inflation subsiding from its spring peak. This could allow Brazil’s central bank, Banco Central do Brasil (BCB), to begin easing in 2023. The Selic Rate, the BCB’s key rate, had held steady since August, setting it apart from other central banks that still appear behind the curve in many cases.5

An important aspect of the bank’s success in reining in inflation may have been its formal autonomy from the government, thanks to a 2021 bill originally supported by Bolsonaro (which he later regretted). Under a Lula presidency, this could act as another guardrail against unchecked spending. A dramatic example has been established before our eyes in the United Kingdom recently. More generally, an independent central bank is an accomplishment in itself that should serve the country well in the future.6 Of course, this does not mean that Brazil is out of the woods yet in terms of inflation. Sunset-claused fuel subsidies and tax cuts have contributed to the falling price pressure, and structural issues like supply chain disruptions and geopolitical risks remain unresolved. If the BCB turns too dovish too soon, pressure on the currency could quickly drive inflation back up.

Finally, commodity-based exports may experience a slowdown as the global economy, and particularly China—Brazil’s top trading partner—enters a lower growth phase, with recession risks looming. It is important to keep in mind, however, that Brazil’s GDP is largely driven by domestic consumption. Stable or falling interest rates, the lowest unemployment rate since 2015, rising real wages and improved confidence mean that Brazilian consumers are arguably in a good shape, especially compared to many markets in the developed world.

The biggest short-term risks are an escalation of political tension or a prolonged sense of market uncertainty. We believe that Lula’s inauguration should see markets look beyond politics and focus on the fundamentals as well as the opportunities brought by the new administration—infrastructure projects, a fresh focus on a green transition, investing in education and bolstering the domestic economy. Lula is a known quantity in Brazil. The economy flourished during most of his prior term, and based on recent performance, both domestic and international investors seem moderately optimistic about his return to power. While they will have to evaluate policies against pledges, Lula is inheriting an economy on solid footing with significant long-term potential.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: Reuters, “Brazil’s Bolsonaro says he may not accept 2022 election under current voting system,” July 7, 2021.

2. Reuters, “Brazil central govt posts better-than-expected primary surplus in September,” October 27, 2022.

3. Source: CEIC, “Brazil Government Debt: % of GDP,” 2022.

4. Source: Bloomberg, 2022. The FTSE Brazil 30/18 Capped Index represents the performance of Brazilian large- and mid-capitalization stocks. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator of future results. See www.franklintempletondatasources.com for additional data provider information.

5. Source: Banco Central do Brasil, 2022.

6. Source: Central Banking Publications, “BCB independence and Brazil’s inflation battle,” November 16, 2021.

English

English Français

Français Español

Español